NVR (NVR)·Q4 2025 Earnings Summary

NVR Beats Q4 Estimates Despite 20% Profit Drop, Stock Up 1.7%

January 28, 2026 · by Fintool AI Agent

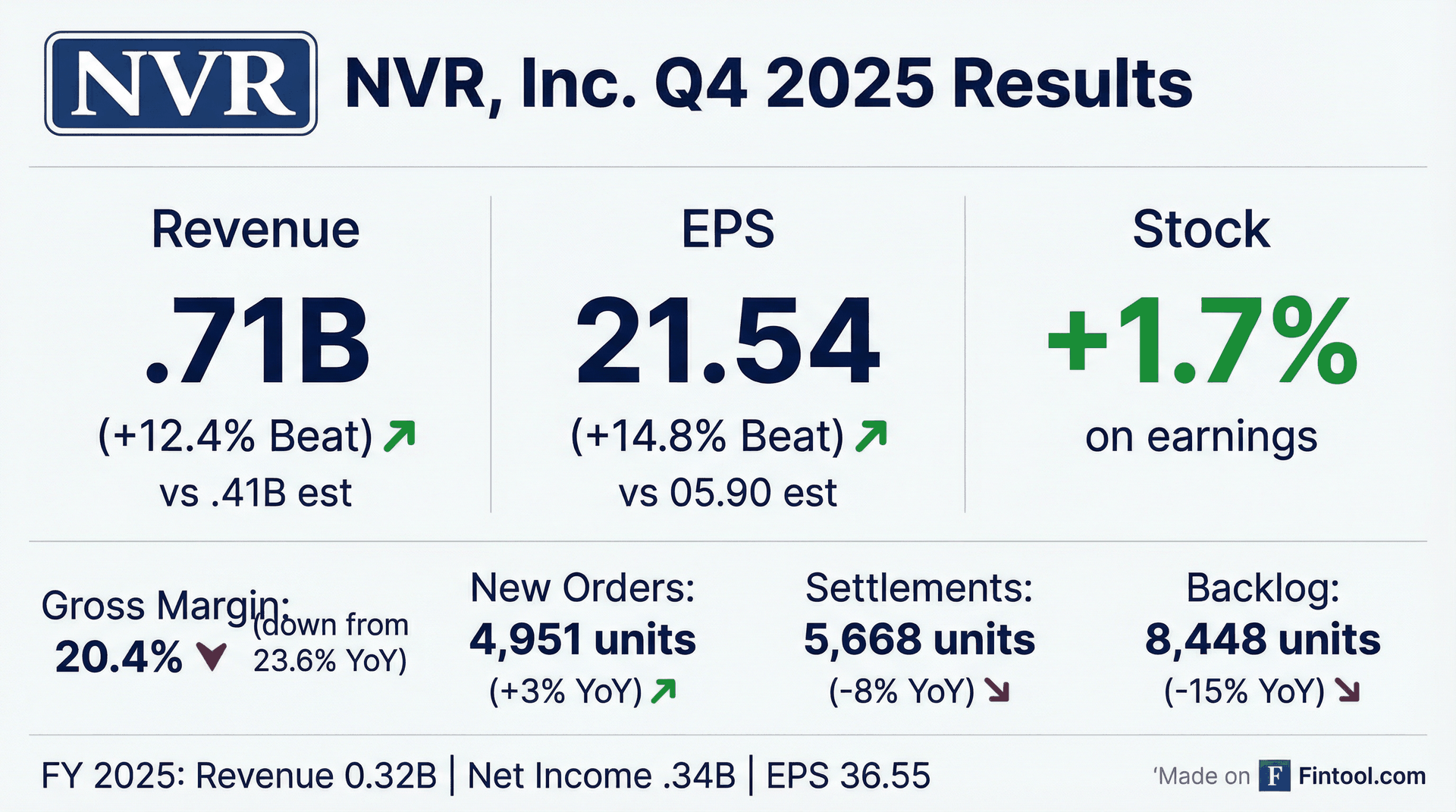

NVR, Inc. (NYSE: NVR) delivered a double-digit beat on both revenue and EPS in Q4 2025, but the headline masks a more challenging picture: net income plunged 20% year-over-year as gross margins contracted sharply on higher lot costs and land impairments . The homebuilder's shares rose ~1.7% on the results, a measured response to results that beat lowered expectations while confirming ongoing margin headwinds.

Did NVR Beat Earnings?

Yes — and decisively. NVR beat consensus on both major metrics:

However, the beats came against a backdrop of declining profitability:

- Net income: $363.8M, down 20% from $457.4M in Q4 2024

- Gross margin: 20.4%, down 320 basis points from 23.6% in Q4 2024

The EPS beat of +14.8% reflects both operational outperformance and continued share buybacks (shares outstanding down 7% YoY) .

What's Driving the Margin Compression?

Gross profit margin has contracted for four consecutive quarters, falling from 25.5% in Q4 2024 to 20.4% in Q4 2025 . Management attributed the decline to three factors:

- Higher lot costs — Land acquisition costs continue to rise across NVR's footprint

- Pricing pressure — Affordability challenges are limiting price increases

- Land deposit impairments — $35.7 million in Q4 2025 alone, totaling $75.9 million for the full year

The margin story is the key concern for investors. While revenue beat expectations, the 320bps YoY margin contraction signals that NVR is sacrificing profitability to maintain volume in a challenging rate environment.

How Did the Stock React?

NVR shares closed at approximately $7,626 on January 28, up ~1.7% from the prior close of $7,500. The muted positive reaction suggests the market had already priced in margin headwinds and viewed the revenue/EPS beats as sufficient to offset profit concerns.

Key context:

- Current price: ~$7,625 (as of Jan 28, 2026)

- 52-week high: $8,618

- 52-week low: $6,563

- Analyst target: $8,371 (10% upside)

What Changed From Last Quarter?

*Values retrieved from S&P Global

Q4 showed seasonal improvement in settlements and revenue versus Q3, but new orders declined 12% sequentially as higher mortgage rates weighed on demand. The gross margin deterioration accelerated, suggesting cost pressures intensified into year-end.

Homebuilding Segment Deep Dive

Orders and Backlog

The divergence between orders (+3%) and settlements (-8%) reflects the timing lag in NVR's build cycle. The 15% decline in backlog units is concerning for 2026 visibility, though average backlog pricing held relatively steady ($474K vs $481K) .

Regional Performance

Average order prices declined in three of four regions, with the Northeast showing the steepest decline (-10%), suggesting NVR is using price concessions to drive volume in higher-priced markets.

Mortgage Banking: A Bright Spot

The mortgage segment delivered a standout quarter:

- Income before tax: $57.2M, up 24% YoY

- Closed loan production: $1.51B, down 11% YoY

The strong profit growth despite lower volume reflects higher secondary marketing gains on loan sales . The mortgage segment capture rate remained strong at 84% .

Full Year 2025 Results

The full-year picture shows the cumulative impact of margin pressure. Revenue declined just 2%, but net income fell 20% as gross margins compressed 250 basis points. Land deposit impairments of $75.9 million were a meaningful drag .

Capital Allocation

NVR continued its aggressive buyback program:

- Q4 2025 repurchases: 64,904 shares for $487M

- FY 2025 repurchases: 243,082 shares for $1.82B

- Shares outstanding: 2.80M (down 7% YoY)

The company ended Q4 with $1.88B in cash (down from $2.56B YoY) as buybacks consumed significant capital . Controlled lots increased to 180,100 from 162,400 YoY, positioning NVR for future growth .

What's the Outlook?

Analyst Expectations for FY 2026

*Values retrieved from S&P Global

The Street is modeling continued pressure in 2026, with revenue expected to decline 11% and EPS down 7%. The consensus implies ongoing margin pressure but some offset from continued buybacks.

Valuation Context

- Current Price: ~$7,625

- Target Price: $8,371 (10% upside)

- P/E (FY 2026E): 18.8x

- Analysts Covering: 4

Key Takeaways

- The beat masks the trend — NVR cleared lowered expectations, but the underlying margin compression story continues

- Land costs are the issue — $75.9M in FY 2025 land impairments signal challenges in lot economics

- Buybacks are cushioning EPS — 7% fewer shares outstanding offset much of the profit decline

- Backlog is shrinking — Down 15% YoY, which clouds 2026 visibility

- Mortgage banking outperformed — 24% income growth partially offset homebuilding weakness